How Dividends Can Impact Stock Market –

There are many different factors that affect stock prices. Demand and supply plays an important role in the up and down of the stock prices. Some other factors include fear and greed. There is something else when the company pays the dividend. In real stock market trading, it isn’t always a case. At any event, you must know the terms like ex-dividend, payout date and record date to know how the company’s dividend policy will affect the trading price of the stock.

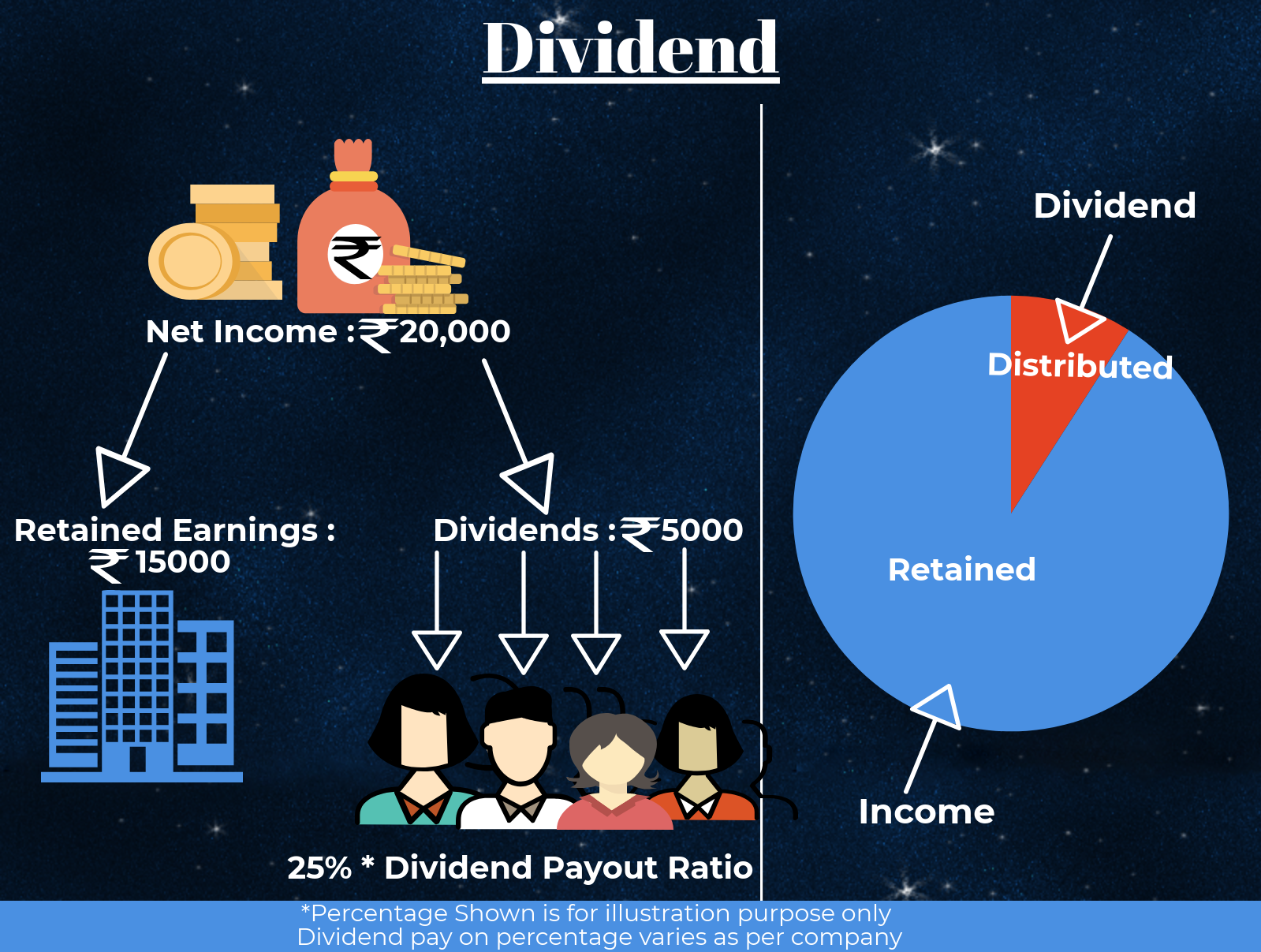

The company will issue dividends in stock or cash. Generally, they’re paid from the specific periods, generally quarterly/annually. In essence, these are the share of the company profits, which are paid to the owners of a stock. The dividend payments will affect equity of the company and distributable equity is reduced.

What happens when dividends falls?

If any company reduces dividend that it pays on the stock, then the stock is less attractive to the investors. It means the stock price may drop. Suppose you have this stock, you won’t just get the lower dividend, but your share prices will fall as well. Market reacts quickly to any dividend changes, thus even a small hint of the dividend reduction will cause the stock to fall down in the price.

What happens when dividends increase?

When the dividends increase, stock gets attractive to the buyers. This increased demand may make sellers to increase the price to get more profits. Suppose you have this dividend stock, then share price may go up as dividend rises. Generally, investors consider increasing dividends the sign of company’s good health. Ensure company issues dividend stock reports of their growing profits all along with the rising dividend. Also, avoid those companies that increase their dividends by not increasing the profits to make the stock look attractive, because such companies might not pay an increased dividend with time.

How to anticipate such change in dividends?

You must pay attention to several non-company indicators or reports so you may anticipate any changes in the dividends. Continue with the analyst ratings or expectations, industry announcements and news headlines that can affect the company issuing your stock. You can use these market signals to decide whether dividend will increase or fall so that you will make buying or selling decisions before you receive any announcement of the reduced or high dividend.

Leave a Reply