Exchange traded funds – What It Is All About?

Exchange-traded funds are a simple or low-cost way of getting investment returns just like share index or underlying asset. But, some ETFs are highly risky and complex than others. So, here we will explain the challenges and what you have to know before investing in it.

Exchange-traded funds are securities that resemble index funds; however, it can be bought or sold during a day like common stocks. The investment vehicles allow the investors ease to purchase the basket of securities just in one single transaction. ETFs, offer complete convenience of the stock all along with the mutual fund diversification. ETF is the basket of stocks, which replicates the composition of Index, like BSE Sensex or S&P CNX Nifty. ETFs trading value can be based on the asset value of an underlying stock it represents. Just think of this as the Mutual Fund you buy and sell at the price that will change throughout a day.

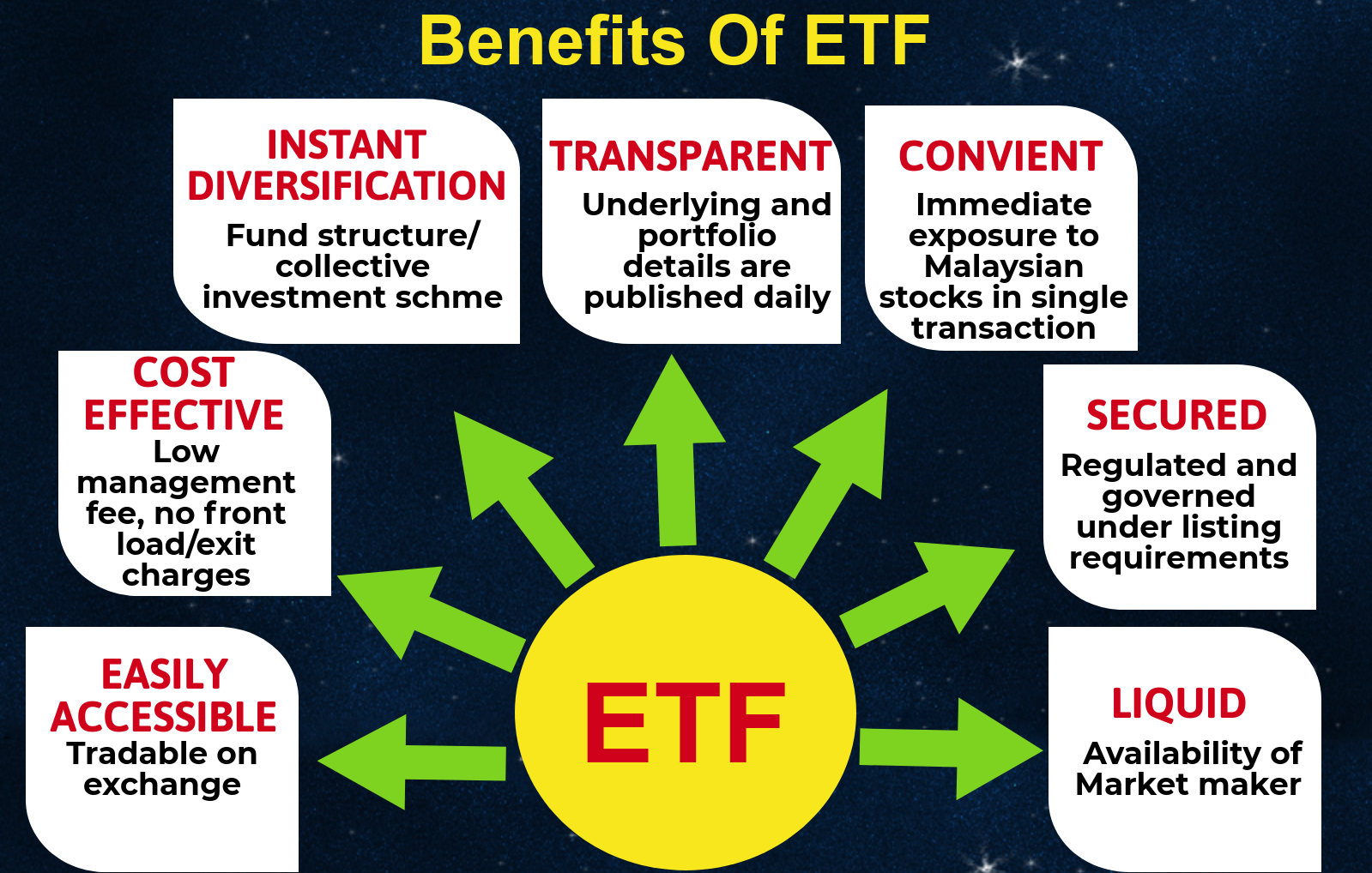

Benefit of ETF –

- Trading like any other stocks

– You may buy and sell ETF during the market hours on the real time basis and put any advance orders on your purchase like stops or limits. In conventional mutual funds, buy and sale is done just one time in a day after your fund NAV gets calculated.

- Low investment cost

– ETFs are known as the lowest expense ratios than others scheme, it is passive investment style and low turnover that helps to keep its costs low.

- Diversification gain

– For Nifty ETF, you have the full basket of over 50 stocks and stay diversified.

- Easy and transparent

– Underlying securities are well known and the quantities are also pre-defined (for conventional fund schemes, one has to wait for monthly factsheet). There is no form filling required when you transact in a secondary market. The investment is made straight from the exchange or fund house.

- Supports small investments

– ETFs are the best tool for the investors who want to start with the small corpus. Minimum ticket size has to be 1 unit (for IIFL Nifty ETF, one unit is 1/10th of the Nifty level, that is Rs500, if Nifty is 5000). The premium and discount tends to be much higher in futures segment, than ETFs.

- ETFs are taxed just like stocks

– Investors will take benefit of the special rates for the short term and the long-term gains.

Target audience

- First time investors

- Long term investors

- Traders who don’t have enough of capital for investing in the index futures

- Investors looking for the low cost portfolio

- Arbitrageurs to do operations with the low impact cost

- Institutional investors who want to park cash temporarily during the portfolio transition

Before Investing in Exchange Trade Funds

- The main goal of Exchange Trade Funds is to be an index and not to beat an Index.

- One can invest in exchange trade funds with a lot of secondary market liquidity

- Always invest in the key benchmarks ETFs instead sectoral funds –

- Investor will need to bear cost of brokerage or other statutory levies like Securities Transaction Tax and more, when units are purchased and sold on a stock exchange.

Leave a Reply