Bonus Issue And Its Effects Of Stock Price –

Bonus share is a free share of the stock given to the current shareholders of a company. It is based on number of shares that a shareholder owns. While an issue of the bonus shares will increase the number of shares owned and issued, it doesn’t increase the company value. Even though total number of the issued shares increases, ratio of shares number held by every shareholder stays constant. Issue of the bonus shares is been referred as the bonus issue. That depends on the constitutional files of a company, only some classes of shares will be entitled to the bonus issues, or can be entitled to the bonus issues for other classes.

What’s Bonus issue?

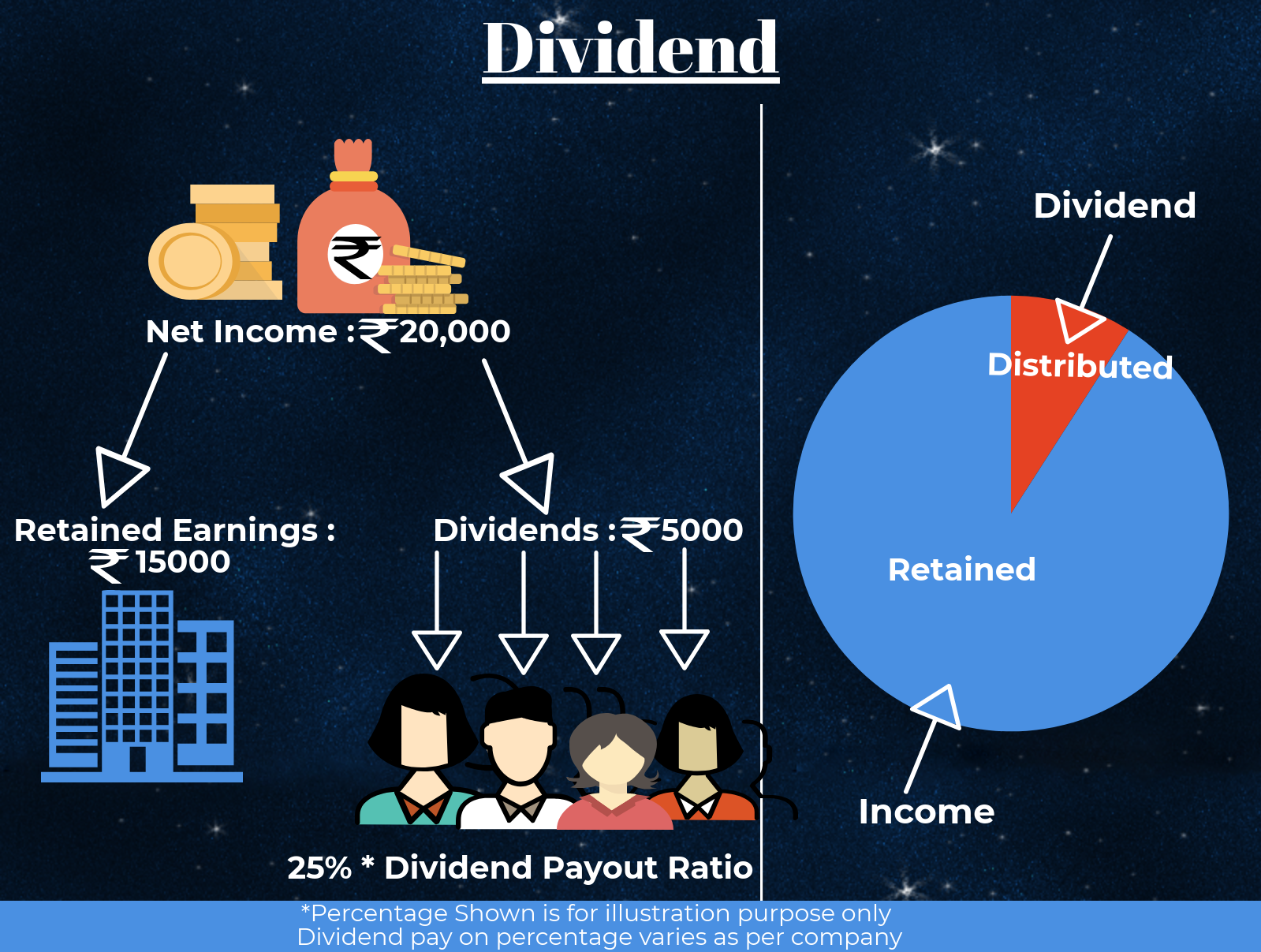

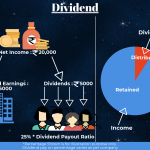

The company will reward their investors through bonus shares or through dividends. When the company declares their bonus issue, investors get bonus shares for the number of the company shares that they hold.

Let’s say for an example: If a XYZ company announced their bonus share 1:1 that means a shareholder will get 1 share for every 1 share he holds. Thus, if you hold 50 shares of XYZ company, so your net holding gets 100 shares. You don’t have to pay anything for the shares.

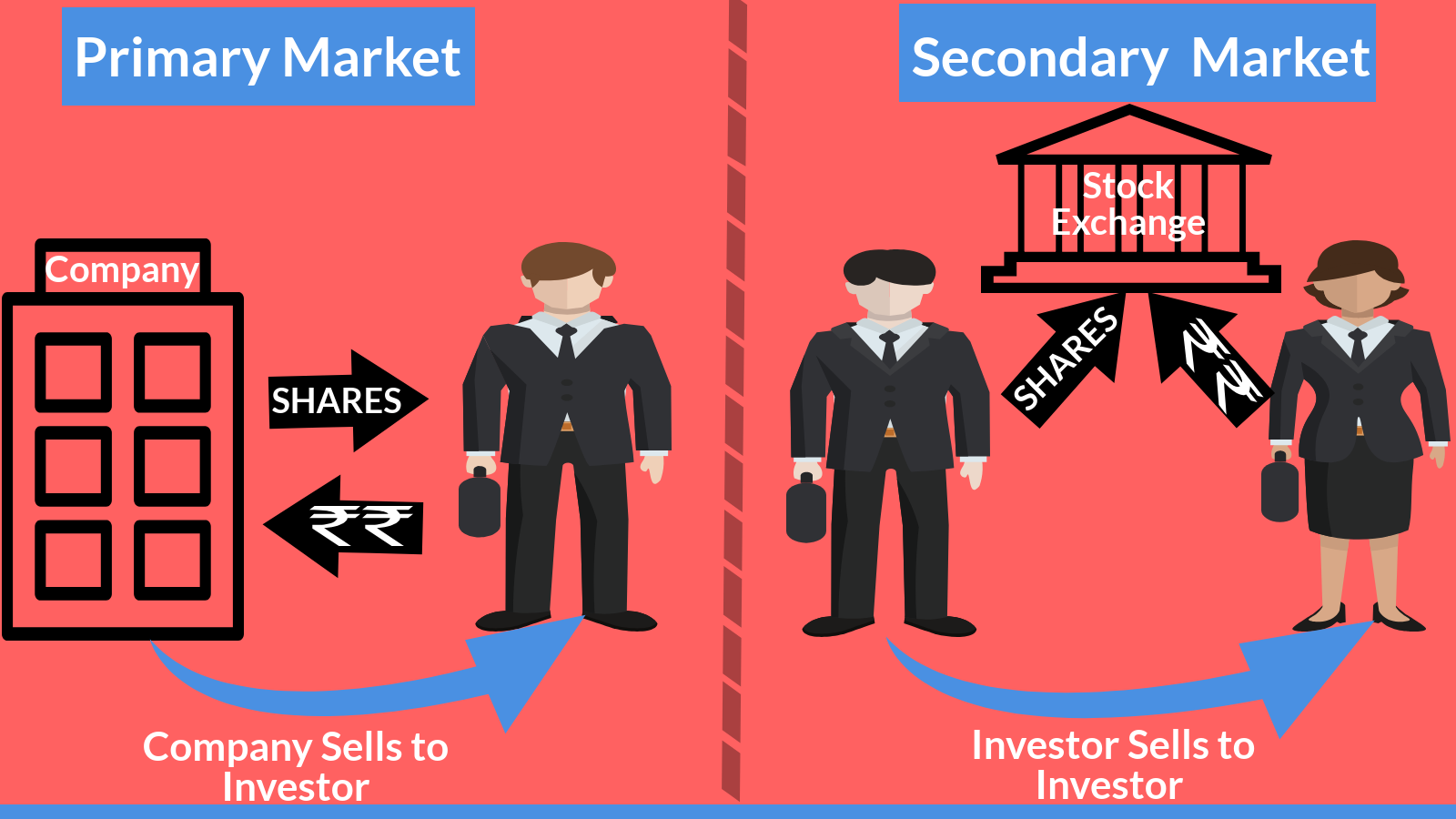

The bonus issue (scrip issue) is the stock split where a company issues the new shares without any charge to bring the issued capital in order with the employed capital (increased capital accessible to company after profits). It generally happens after the company has made some profits, and increasing the employed capital. Thus, bonus issue is seen as an option to dividends. And no new funds will be raised with the bonus issue.

Unlike the rights issue, the bonus issue doesn’t risk diluting any of your investment. Even though earnings for every share of stock may drop with proportion to new issues, it is compensated by a fact that you can have more shares. Thus, value of the investment must stay the same though the cost may adjust accordingly. This entire idea behind an issue of the Bonus shares is bringing Nominal Share Capital in line with true excess of the assets over liabilities.

Are bonus shares miraculous?

There are some things that match the joy of getting the fat bonus on work. This is what the shareholders of a good company will feel when the company wants to throw some shares (free) into their direction. Here is explaining what the bonus shares are and why investors want to invest in these companies. The free shares are offered to you and called as bonus shares. Earn money with the shares and they are the additional shares issues that are given free to the existing shareholders.