What Are Financial Instruments Of Stock Market?

Financial markets collectively bring millions of people together from across the world a wide range of financial instruments. Being one of the biggest markets, there’re many different securities and instruments that you can trade as well as take benefit of the price movements to get in optimal profit.

Traders and investors will turn to the stock market in order to achieve short term profits and to accomplish long-term financial goals, like retirement. When the equities falter, it will reduce the investment portfolio value made up mainly of stocks. Fortunately, there are a few financial instruments that belong to the separate asset classes, which aren’t generally linked to the performance of an equity market. Select the best ones to buy. It depends on the length of time that the investor has exposure and the amount of risk that he is able to tolerate.

Bonds –

The reason why the prices of the stock fall are that the corporate profits that drive market values are compromised. Bonds also known as fixed-income securities aren’t driven by the same conditions. Instead, the bonds are very sensitive to the interest rate environment or type of economic expansion that a particular region is experiencing.

Mutual Funds –

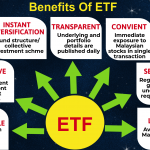

Mutual funds in India are quite popular firstly because of investment is less Eg:- you can start with low as Rs 500 SIP and secondly Risk is diversified. A mutual fund allows the people to invest their money Lump sump and to have this managed professionally. Mutual funds have the sound regulation so that there is no insecurity. There are a lot of thematic mutual funds one can select from, risk and reward might differ as per the plan.

Derivative Instruments –

There’re two types of derivative instruments –the futures and the options. Futures are contracts and agreement of two parties to buy or sell the fixed quantity of their assets at the particular time in future for the fixed rate. The option is similar contract, only that parties aren’t obligated to fulfill any terms of agreement. The contracts are traded in a market. Minimum value of the contract can be 2 lakhs.

Commodities –

In stable economic conditions, the commodities that are the contracts representing price for the resources like precious metals, energy, and agricultural products, will trade uniquely to the equities. When stock market declines, traders and investors will turn to the commodities for diversification. Simplest way for the retail investors to get exposure to the commodities is through exchange-traded mutual funds. In some economic conditions, line between the stocks and the commodities gets blurred.

Secondary Market –

In secondary market, earlier issued bonds, stocks, futures and options are bought and sold. In a secondary market, value of cost depend on demand and supply. The companies can influence the stock prices in secondary market, by various methods such as buybacks. Secondary market is a market for the outstanding securities and allows price discovery. Market value of the shares provides value to a Company.

Leave a Reply